If you often drive for work, having a mileage tracker app on your device is a good idea. The app tracks your mileage and makes the report to help maximize your tax deductions. Many come as a complete solution to track business or personal miles while taking care of receipt management and expense tracking.

A digital mileage tracker is always better than a traditional one, where you must deal with a lot of paperwork and make efforts to store them properly. An app automatically logs the travel distance when you enter the start and stop points. More conveniently, some apps use your phone’s GPS to start tracking when you make a move. And don’t forget to get the top travel apps for iPad and iPhone if you own an iOS device.

12 Best Mileage Tracker App To Save Time And Money

The best mileage tracker app must-have features like ease of use and automatic tracking of mileage so that your business expenses and taxes are managed without much hassle. We have got an exciting list of some of the best mileage tracking apps that work in the background on your phone.

1. TripLog

TripLog is an automatic mileage tracker app, more popular than any other. With its intuitive interface, it makes mileage tracking for individuals and companies a lot simpler. In addition, it creates mileage logs to make mileage reimbursements automated. This makes work simple during tax time.

With a simple swipe in TripLog, you can assign trips to business and personal categories. In fact, you can automate the process by setting work hours to identify business travels. The app lets you connect to the expense and payroll provider you are using to make way for seamless integrations.

Price:

Single User

- Lite: Free

- Premium: $4.99 per month

Multiple Users

- Teams: $10 per user per month

- Enterprise: $15 per user per month

Get TripLog for iOS / Get TripLog for Android

2. Zoho Expense

Zoho Expense is an advanced mileage tracking app with four different ways to track mileage – via GPS, based on the distance covered, point-to-point map locations, and odometer readings. You can have different mileage rates suiting the needs of different departments, vehicles, and policies.

Zoho Expense creates an analytic report to understand the mileage expenditure trends. If you are a business owner, you can access the report for each employee and find out ways to allocate the budget efficiently. Other handy features of the app are receipt and expense management to ensure every expense is correctly recorded.

Price:

Use Zoho Expense as a free app, or pick a paid plan.

- Standard: $99 per active user per month

- Premium: $199 per active user per month

- Enterprise: $299 per active user per month

Get Zoho Expense for iOS / Get Zoho Expense for Android

3. Rydoo

Rydoo is an expense management software that also performs automatic mileage tracking. You can set up the mileage rates in the mileage tracker app for correct calculations. To make accurate mileage tracking, employees use the Rydoo integrated map service whenever they make a trip. Then the mileage rate is added to determine the distance covered and expenses.

Rydoo uses a smart corporate card to submit and approve expenses instantly. This ensures better control over expenses. If you get pictures of receipts, the app can get the necessary details from them to make calculations. The advanced rule engine lets you set the right policies compliant with your company.

Price:

- Essentials (Minimum 5 users): €8 Per user, per month when billed annually

- Pro (Minimum 5 users): € 10 Per user, per month when billed annually

- Enterprise: Custom pricing

Get Rydoo for iOS / Get Rydoo for Android

4. MileIQ

MileIQ automatically tracks miles using an easy-to-use application. The app works silently on your device to track the business drives. It lets you save business miles separate from personal by simple swipes. Swipe left for personal and right for business, and the classification becomes super easy.

MileIQ is a mileage tracker that features a dashboard to show the details of all your drives. When you click the Send Report button, you get the mileage report. So if you have a whole team to manage, the app offers a complete mileage solution. And you can trust MileIQ with your data, thanks to the bank-grade security.

Price:

Personal:

Get the trial version or MileIQ Unlimited for $59.99 per year.

Team:

- Teams Lite: $50 per user per year

- Teams: $80 per user per year

- Teams Pro: $100 per user per year

Get MileIQ for iOS / Get MileIQ for Android

5. QuickBooks Online

QuickBooks Online is an accounting software that can also be a mileage tracker app if you own a vehicle for business or personal use. Save your business miles and vehicle expenses in the app and get all details ready for tax deductions. The mobile apps come in handy while you are always on the go as it uses your phone’s GPS.

When you start your drive, open the app and classify the drive, and the app takes care of the tracking of mileage. You can also track your drives on a web browser. You will get detailed mileage reports that can be shared easily.

Price:

- Simple Start: $9 per month

- Essentials: $16.50 per month

- Plus: $25.50 per month

- Advanced: $60 per month

Get QuickBooks Online for iOS / Get QuickBooks Online for Android

6. FreshBooks

FreshBooks offers the convenience of auto-logging of your business trips. The app saves your travel history for future reference. Swipe your screen left or right to categorize a drive as business or personal. Download the mileage report or send it to your email address when it is ready.

FreshBooks stands apart from others by letting you know what tax deduction you can possibly get for a journey. In addition, your manual effort is largely reduced because the reports are ready-made. If you own a small business, don’t hesitate to get the app, as it has many attractive features.

Price:

- Lite: $8.50 per month

- Plus: $15 per month

- Premium: $27.50 per month

- Select: Custom pricing

Get FreshBooks for iOS / Get FreshBooks for Android

7. Timeero

Timeero comes with a simple mileage tracker app that accurately records employee routes with starting and ending times. The mileage logs are easy to understand and save you time and money. It is the perfect tool to collate the mileage data to make informed decisions.

Timeero integrates efficiently with payroll providers like QuickBooks. So, you can export the mileage data to your payroll software for further processing. With the app, you get a better idea of the business expenses. The secret to the efficiency of Timeero is using geofencing technology to streamline all activities. It ensures IRS compliance and offers the peace of mind you need.

Price:

- Premium: $11 per user per month

- Pro: $8 per user per month

- Basic: $4 per user per month

Get Timeero for iOS / Get Timeero for Android

8. ExpensePoint

ExpensePoint comes with many features, and mileage tracking is an important one. The app uses your mobile device’s built-in GPS to track mileage. And then, with a single swipe, you can create the mileage expense report. Once the report is ready, the app applies the organization’s reimbursement rate.

The mileage reports have data like the map and routing information to make everything transparent. So all the data is easily visible to the commuters and the expense managers. In addition, ExpensePoint has other features like a receipt imaging system, credit card integration, data integration, and more. You may also get the top travel apps for Android that take care of mileage tracking and many other features for frequent travelers.

Price:

Get ExpensePoint for $8.50.

9. Shoeboxed

A million businesses trust Shoeboxed with their data extraction. It also comprises a powerful mileage tracker app, among many others. The app makes expense reporting and tax preparations effortless. Small business owners can greatly benefit from the feature to eliminate manual mileage tracking difficulties.

For accurate tracking of mileage, Shoeboxed uses the GPS of your device. You can specify the start and end points for the app to calculate the miles traveled. It then calculates the reimbursement amount with the mileage rate given. When the expense report is done, it easily integrates with any payroll software.

Price:

- Start up: $18 per month

- Professional: $36 per month

- Business: $54 per month

Get Shoeboxed for iOS / Get Shoeboxed for Android

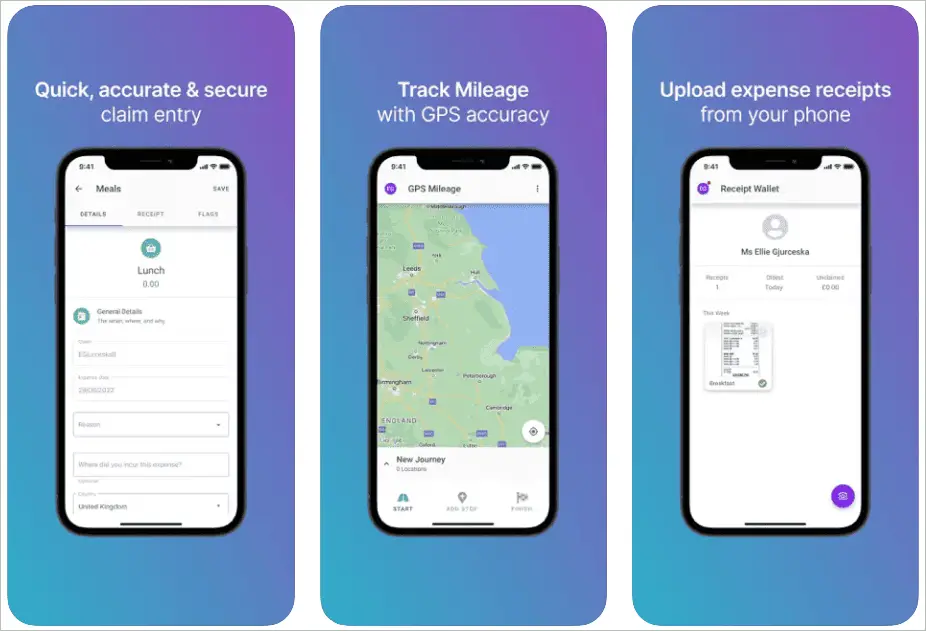

10. Expenses Mobile

Simplify your business expense management using Expenses Mobile. It is an exclusive mobile app with a mileage-tracking feature in its custody. It lets you save all your receipts digitally and build accurate expense claims. It uses GPS technology for tracking miles, so the app will never go wrong with calculations.

Expenses Mobile makes the process of submitting, approving and reimbursing your travel expenses super simple. It automatically tracks your journey to make a complete report for tax deductions. This makes for a quick claim entry respecting the company policy.

Price:

Expenses Mobile is a free mileage tracker.

Get Expenses Mobile for iOS / Get Expenses Mobile for Android

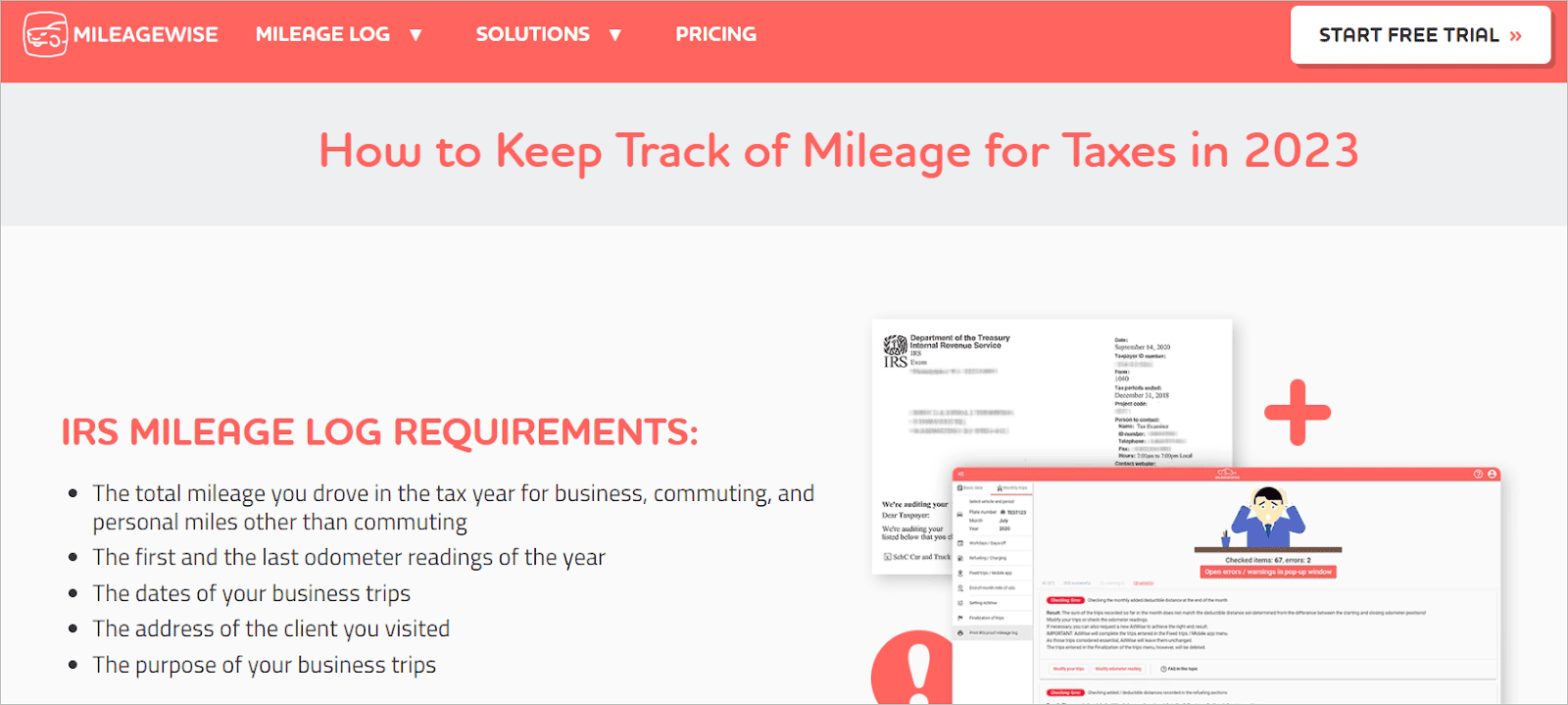

11. MileageWise

MileageWise is a mileage tracker app for tracking mileage automatically. It features a web dashboard for IRS-proof mileage logs. So, if there is an IRS audit, you can be absolutely ready with your reports. Even if you don’t possess the mileage log for a specific time frame, the app helps you make one using Google Maps records.

MileageWise enables tracking miles that are recorded in fragments. For example, if you’re a rideshare driver who works for multiple companies like Uber and Lyft, you can combine your separate mile logs in the same platform to claim your deserved tax benefits.

Price:

You can log in to MileageWise and get custom pricing for your requirement.

Get MileageWise for iOS / Get MileageWise for Android

12. Everlance

Tracking miles and expenses is made simple by Everlance. The app auto-detects and tracks your journey when you go for a drive. But you can also manually enter the trip details if you want. You can then classify the trips as personal or work and download the mileage and expense reports on your device.

With Everlance, getting your reports as PDF or Excel files is possible. It uses GPS tracking to record the miles. The app scans your expenses to identify those with potential tax deductions. The app has two versions; one for small businesses and one for self-employed.

Price:

Companies:

- FAVR Program: $33 per user per month

- CPM Program: $10 per user per month

Individuals:

- Premium Plus: $10 per month

- Premium: $5 per month

Get Everlance for iOS / Get Everlance for Android

Final Thoughts

Using a mileage tracker app takes a lot of burden off your shoulders concerning your personal or business trips. When you have the miles driven stored digitally, the app will calculate using the specified mileage rates to give you accurate reports.

The article suggests the leading mileage tracker applications to get mileage tracking and expense reporting on track. These offer free trials, so you don’t have to decide hastily. Of course, not all will be the best for your requirements, but each lets you go paperless.